Customized banking solutions

Our innus.banksuite is 100% designed, developed and operated in Germany.

Using modern methods, we realize all necessary documentation as part of our product. innus achieves high coverage and seamless history through automated tests integrated into the build process.

Organization

- User and application management

- Security management

- Role design

Accounting

- Accounts and journal entries

- Balance sheet and income statement (multi GAAP and multi-currency)

- Foreign currencies

Product Management

- Current account and deposit products

- Credit products

- Fees and interest of any kind

- Loan collateral

Distribution

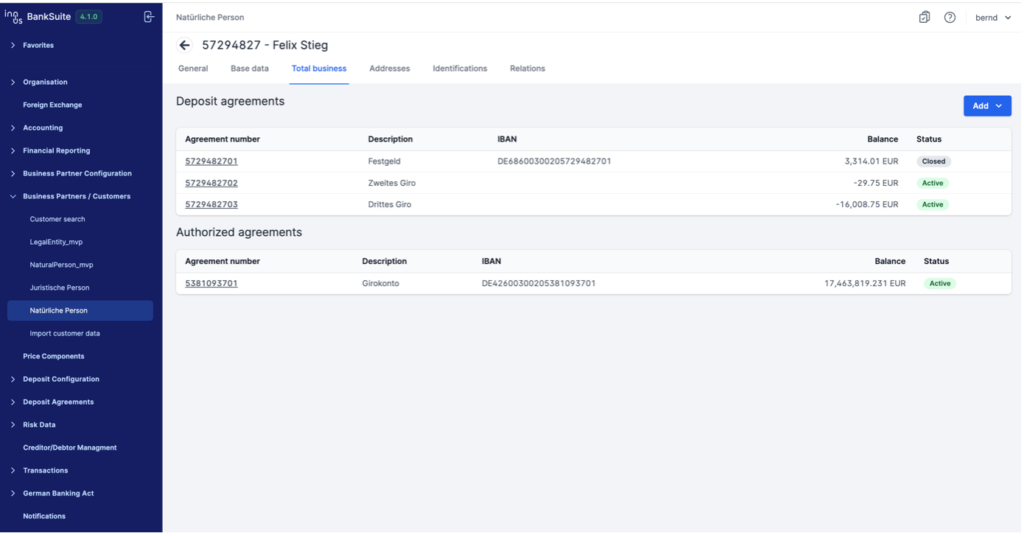

- Business partner data management

- Credit application route

- Application route for current account and deposit products

- Online application route

Revision

- Audit log

- Mandatory fields

Satellite systems

- B2B service for the integration of business partners

- Notifications

- Reporting

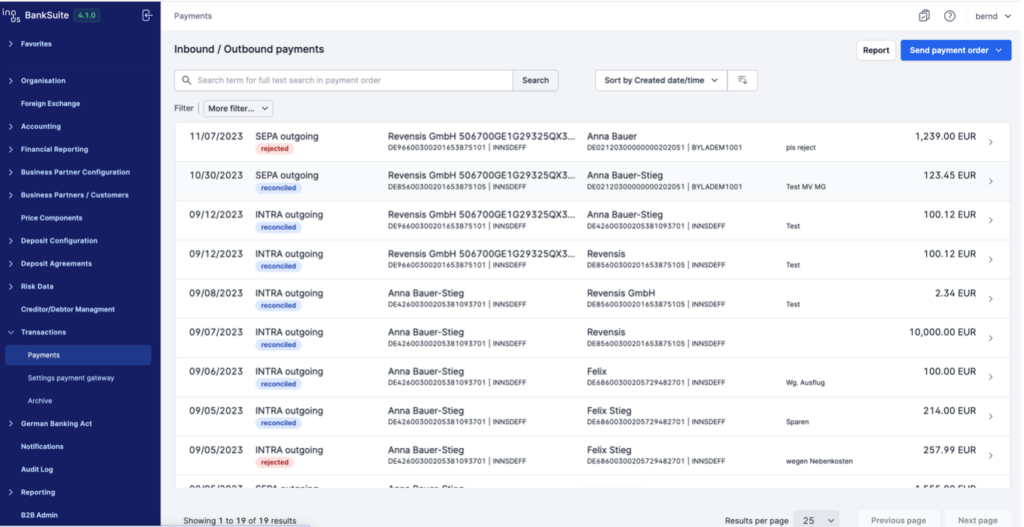

- Payment transactions (ISO 20022)

- Identification, KYC, AML Sanctions and Transaction screening

Overall bank management

- Interest rate risks

- Liquidity risks

innus.BankSuite is a customized core banking solution based on standards, developed with a high level of integration capability for the special requirements of financial institutions. The focus of the functions is on customer-oriented core businesses and their processes.

Organization

The innus.BankSuite ensures efficient management of users, roles and access rights. Functions include the management of user accounts and applications, comprehensive security functions to control access to sensitive data and flexible role design. Detailed logging of changes and events ensures traceability and security.

Accounting

The innus.BankSuite accounting system includes the professional processing and management of financial data. Important functions include the management of all accounts and journal entries, the creation of balance sheets and income statements according to various accounting standards (Multi GAAP) and in various currencies. Foreign currency management and accounts payable and receivable management are also included.

Product Management

The innus.BankSuite product management enables the flexible administration and customization of banking products and services. This includes the management of current account and deposit products as well as credit products, the management of credit limits and collateral, the definition and management of fees and interest as well as the processing of transfers, direct debits and real-time transfers in accordance with the ISO 20022 standard.

Distribution

The distribution of innus.BankSuite focuses on the management of business partners and the integration of sales processes. Functions include business partner data management, the B2B service for easy integration of business partner processes, automated notifications and alerts as well as optimized online application routes for loans and current account and deposit products.

Risk management

Risk management in innus.BankSuite deals with the identification, assessment and management of risks in the banking business. The most important functions include the monitoring and management of interest rate risks in accordance with the IRRBB standard, the management and planning of liquidity risks as well as financial and capital planning.

Satellite systems

The satellite systems of innus.BankSuite enable the integration of external systems and services into the core banking system. This includes functions for identity verification (Identification), compliance with KYC guidelines, monitoring of sanctions (AML Sanctions) and transaction monitoring (Transaction Screening).

Revision

The innus.BankSuite audit includes functions for monitoring and documenting system activities. This includes the audit log with detailed logging of all system activities and mandatory fields that ensure the recording of all necessary information to ensure data integrity and completeness.

Thanks to the service-oriented approach and phased adoption, innus.BankSuite can be tailored to the individual needs of each financial institution and can therefore be used as a supplement to existing legacy systems or as a fully comprehensive core banking system.

Contact us to find out more about our services and functionalities and how we can help you optimize and future-proof your banking processes.